When it comes to financial markets such as foreign exchange, stock, and bonds, there needs to be some mechanism offering liquidity to trade in the asset. For those new to the term, let me explain what liquidity is. Because hereafter, you’re to encounter the word every now and then.

Liquidity refers to the ease with which an asset, or security, can be converted into ready cash without affecting its market price. This article will figure out how liquidity functions within a decentralized financial (DeFi) ecosystem.

As of March 2022, there are almost 80.22 billion dollars of value locked in DeFi protocols. The interesting part is the ecosystem is rapidly expanding with newer product types.

Well, how is this expansion taking place?

Have you ever had a look ??

One of the core catalysts behind this is the liquidity pool.

Liquidity pools facilitate lending, trading, and alike in a decentralized stage. It enables users to lend and trade crypto on decentralized exchanges and other DeFi platforms without centralized market makers.

The idea is profoundly simple😊😊😊😊. Let’s take a look.

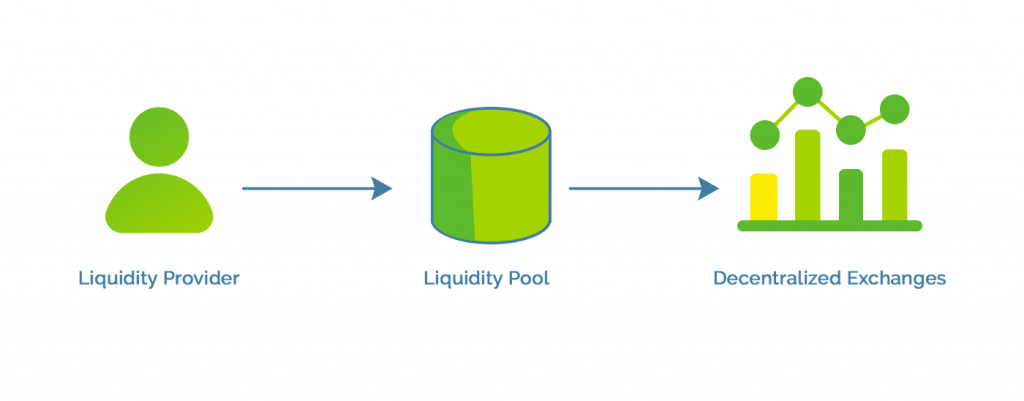

A liquidity pool, in simple words, is a collection of funds locked in a smart contract (Smart contracts are an integral component of DeFi as it helps to automate the DeFi activities). It is a crowdsourced pool of cryptocurrencies or tokens locked in a smart contract to facilitate trades between the assets on a decentralized exchange (DEX).

Liquidity pools provide the much-needed liquidity, speed, and convenience to the DeFi ecosystem. The decentralized finance ecosystem uses the liquidity pools as the mechanism for users to pool their assets in a DEX’s smart contracts, providing asset liquidity for traders to swap currencies.

How is the liquidity pool created?

When traders lock their assets in a smart contract, a liquidity pool gets created. We can define a “pool” as the sum of at least two tokens locked in a smart contract.

And why would traders do that 😕😕 ?

Because they get rewarded.

Yes…..when traders called liquidity providers (LP) add value of two tokens in a pool to create a market, they are rewarded a trading fee proportional to their share of the total liquidity in exchange for their funds. The happiest part is anyone can be a liquidity provider, as AMMs have made market making more accessible.

Now, what’s this AMM??

The rising fanfare behind the decentralized financial markets is their ability to eliminate the intermediaries between transacting parties. One of the unsung behind is the automated market maker protocol (AMM) within these transaction systems. Almost every decentralized finance (DeFi) platform uses automated market makers (AMMs) for trade purposes. Through the use of liquidity pools, the automated market makers allow digital assets to be traded in an automatic and permissionless manner. Well…How?

One can think of AMM as a computer programme that automates the process of providing liquidity. These protocols are built using smart contracts to mathematically define the price of the crypto tokens and provide liquidity. AMM acts as an underlying protocol for decentralized exchanges with an autonomous trading mechanism. It eliminates the need for centralized authorities like exchanges and other financial entities.

Though Bancor was one of the first protocols to make use of the liquidity pool, the concept gained more attention with the popularization of Uniswap. Some other popular exchanges that use liquidity pools on Ethereum are SushiSwap, Curve, and Balancer.

The Working Mechanism

We learned that a liquidity pool is a collection of funds deposited into a smart contract by liquidity providers. The liquidity pools work alongside the automated market makers, which trades as peer-to-contract. So when you’re executing a trade on an AMM, you don’t have a counterparty; instead, you’re performing the trade against the pool’s liquidity. Under AMM, sufficient liquidity in the pool is adequate to get traded, it need not have a seller/buyer at that particular moment. For example, if you’re buying some coin on Uniswap, there isn’t a seller on the other side in the traditional sense. Instead, your activity is managed by an algorithm that commands what happens in the pool. In addition, pricing is also determined by this algorithm based on the trades that occur in the pool.

Employment Opportunities

So far, we’ve mainly discussed AMMs, which have been the most popular use of liquidity pools. However, it can be used in a different number of ways.

One of these is yield farming or liquidity mining. It is a way to generate rewards by locking up funds. How??? Some liquidity pools pay their bonuses in multiple tokens. Liquidity providers can deposit these reward tokens to other liquidity pools to earn rewards there, and so on. It might sound complex, but the basic idea is to encourage the liquidity providers to deposit funds into a liquidity pool while earning some rewards. For example, in the automated yield-generating platform like yearn, liquidity providers add their funds to pools that are then used to generate yield.

The Risks Behind

Firstly, if you provide liquidity to an AMM, you’ll need to be aware of the condition called impermanent loss (IL). Impermanent loss is the risk that liquidity providers take in exchange for fees they earn in liquidity pools. Impermanent loss happens when you provide liquidity to a liquidity pool, and the price of your deposited assets changes when compared to the time of your deposit. The bigger this change is, the more you are exposed to impermanent loss. If IL exceeds fees a user makes when they withdraw, it denotes the user has suffered negative returns compared with simply holding their tokens outside the pool.

Second, is the risks out of the smart contract. When you deposit funds into a liquidity pool, they reside in the pool. Technically no middlemen are holding your funds; the contract itself can be considered the custodian of those funds. If there are bugs or some other exploit, the funds could get lost.

Also, one needs to be wary of projects where the developers have permission to change the pool’s rules. Sometimes, developers can have privileged access to the smart contract code enabling them to potentially do something malicious that could threaten your fund.

Concluding Thoughts

Liquidity pools are one of the integral components of the DeFi technology stack. They facilitate the roll out of multiple financial instruments such as decentralized trading, lending, yield generation and much more. These smart contracts power almost every part of DeFi, and they will continue to do so.